Dooms-day? Is this really 1987 all over Again?

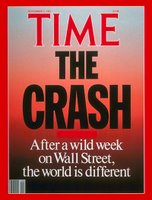

With the markets heading lower once again, I am sitting here with a big grin on my face as I start to pack for vacation. Why am I grinning? I have been scaling out of the markets over the past several weeks and have been advising all MSW members to do the same. My indicators have been turning very weak and the NH-NL ratio has been predicting this type of collapse all year long. As the markets neared multi-year highs and all-time highs, the NH-NL ratio stayed weak; a clear sign that we were watching a false move. I don’t expect to see a magazine cover similar to the Time image I uploaded any time soon but I may be wrong(from November 1987).

With the markets heading lower once again, I am sitting here with a big grin on my face as I start to pack for vacation. Why am I grinning? I have been scaling out of the markets over the past several weeks and have been advising all MSW members to do the same. My indicators have been turning very weak and the NH-NL ratio has been predicting this type of collapse all year long. As the markets neared multi-year highs and all-time highs, the NH-NL ratio stayed weak; a clear sign that we were watching a false move. I don’t expect to see a magazine cover similar to the Time image I uploaded any time soon but I may be wrong(from November 1987).I highlighted some key quotes of mine on this blog from the MSW screens in May which show you how serious I thought this decline could become. It is a coincidence that I am leaving for vacation and the markets are so weak but it works perfectly for capital preservation. I am not worried about a thing because I have moved to sidelines and will enjoy time in the sun with my family as some people continue to average down and pull their hair out (trying to predict bottoms).

Now I will post up a “dooms-day” article that was featured on The Drudge Reportand has now been uploaded to many blogs and financial sites around the web. It is an interesting article from the London Times. A simple look anywhere online or in print will show you how investors are panicking. Gloomy articles are being written by the minute. Enjoy!

The Sunday Times May 21, 2006

Markets ‘are like 1987 crash’

David Smith, Economics Editor

CONDITIONS in the financial markets are eerily similar to those that precipitated the “Black Monday” stock market crash of October 1987, according to leading City analysts.

A report by Barclays Capital says the run-up to the 1987 crash was characterized by a widening US current-account deficit, weak dollar, fears of rising inflation, a fading boom in American house prices, and the appointment of a new chairman of the Federal Reserve Board.

All have been happening in recent months, with market nerves on edge last week over fears of higher inflation and a tumbling dollar, and the perception of mixed messages on interest rates from Ben Bernanke, the new Fed chairman.

“We are very uncomfortable about predicting financial crises, but we cannot help but see a certain similarity between the current economic and market conditions and the environment that led to the stock-market crash of October 1987,” said David Woo, head of global foreign-exchange strategy at Barclays Capital.

Apart from the similarities in economic conditions, during the run-up to the 1987 crash there was a sharp rise in share prices worldwide and weakness in bond markets, Woo pointed out. “Market patterns leading to the crash of 1987 resemble the markets today,” he said.

Equity markets settled on Friday after sharp mid-week falls, with all the main American stock-market measures recording small gains on the day. But nerves remain.

Gerard Lyons, head of research at Standard Chartered, said: “The volatility is explained by tighter liquidity conditions, markets pricing in more for risk and dollar vulnerability. But people forget that this is not a case of emerging-market economies being in trouble as in 1997-8. They’re in good shape.”

The vulnerability of stock markets is likely to add to the case for a prolonged pause before the Bank of England hikes interest rates, analysts believe.

While one member of its monetary policy committee (MPC) voted for a rate hike earlier this month, some recent data, notably subdued labour market conditions, suggest few signs of inflationary pressure.

Base rate is unlikely to rise until next year, according to a survey of analysts by Ideaglobal.com, a financial-research consultancy. It finds a median expectation that the rate, currently 4.5%, will rise in February next year.

Piranha

0 Comments:

Post a Comment

<< Home