A New Short Candidate & Updates

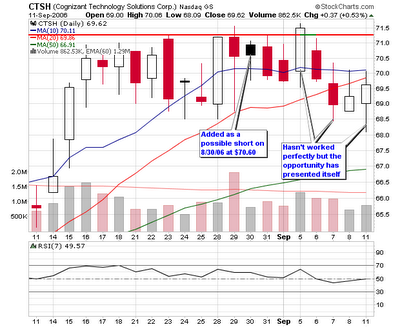

I wrote a post prior to the market open on August 31, 2006 and uploaded four charts of stocks that may be showing a possible short based on a simple bearish divergence technique I have been studying. Three of the four stocks have showed profits with CLB breaking down with the largest profit opportunity.

Based on that blog entry, I have decided to update what has happened over the past couple of weeks and present a new opportunity from my research tonight.

Corrections Corp. of America:

CXW – 66.18, a 4.38% gain on volume only 36% larger than the average. I see a huge bearish divergence on the charts with a short setup. The entry is the day after the stock closes below the previous high which is $65.

As you can see, each stock did make a gain on the short side but the charts show why a couple of them didn’t set up properly. I would also suggest to use an intraday chart to close the position rather than a daily chart. Please see the original post to understand what I was looking for: Possible Short Setups

The stocks listed on 8/30/06:

PSPT - 16.92 (low 15.45 9/7/06) – 8.69%

CLB - 73.00 (low 67.00 9/11/06) – 8.22%

CTSH - 70.60 (low 68.09 9/11/06) – 3.56%

BMC - 26.97 (low 26.16 9/7/06) – 3.00%

I am new to short term trading (long time CANSLIM trend trader/swing trader) and will continue to use the blog to post up what I am looking at with equities.

Piranha

1 Comments:

Chris,

they did work out well for short term trades. Keep it up

Post a Comment

<< Home