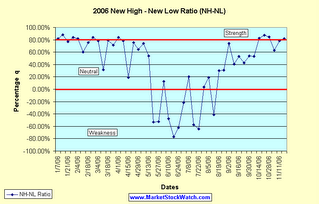

New High - New Low Ratio

Here’s the latest NH-NL ratio chart with weekly numbers updated to the week prior to the Thanksgiving holiday. I excluded the short week so it wouldn’t skew the chart. Although the week ending on Saturday, November 18, 2006 had the highest average number of new highs (541) for the year, the strength calculation ranked it tenth in 2006 behind many of the readings from January and October. New highs were greater during the week of 11/13-11/17 but the strength was less than three of the weeks in October which saw the number of new lows 30%-50% lower. Both sets of numbers play an equal role in the calculation of this NH-NL strength ratio.

Yesterday saw a reading of 525-35 which equals an 87% rating but the readings were weaker earlier in the week so the total won’t make the top 10 (as long as today is quiet). In addition to the NH-NL chart, I wanted to post the chart of the number of stocks on the S&P 500 that are trading above their 50-d m.a. because it has slipped to its lowest level since August.

To calculate the percentage correctly, use this formula:

(New Highs – New Lows) / (New Highs + New Lows) * 100 = X%

Below is an updated look at the weekly averages for the NH-NL Ratio:

Saturday, January 14, 2006: 500-32

Saturday, January 21, 2006: 348-46

Saturday, January 28, 2006: 516-46

Saturday, February 4, 2006: 449-44

Saturday, February 11, 2006: 229-57

Saturday, February 18, 2006: 306-42

Saturday, February 25, 2006: 420-36

Saturday, March 04, 2006: 399-49

Saturday, March 11, 2006: 162-84

Saturday, March 18, 2006: 459-53

Saturday, March 25, 2006: 312-52

Saturday, April 01, 2006: 441-39

Saturday, April 08, 2006: 481-58

Saturday, April 15, 2006: 150-103

Saturday, April 22, 2006: 540-75

Saturday, April 29, 2006: 353-76

Saturday, May 6, 2006: 503-74

Saturday, May 13, 2006: 384-116

Saturday, May 20, 2006: 64-211

Saturday, May 27, 2006: 57-182

Saturday, June 3, 2006: 119-93

Saturday, June 10, 2006: 72-204

Saturday, June 17, 2006: 41-310

Saturday, June 24, 2006: 56-238

Saturday, July 01, 2006: 127-198

Saturday, July 08, 2006: 143-95

Saturday, July 15, 2006: 74-273

Saturday, July 22, 2006: 66 - 307

Saturday, July 29, 2006: 163-151

Saturday, August 5, 2006: 194-132

Saturday, August 12, 2006: 88-210

Saturday, August 19, 2006: 178-96

Saturday, August 26, 2006: 140-74

Saturday, September 2, 2006: 285-42

Saturday, September 9, 2006: 143-60

Saturday, September 16, 2006: 244-75

Saturday, September 23, 2006: 206-83

Saturday, September 30, 2006: 251-75

Saturday, October 7, 2006: 301-92

Saturday, October 14, 2006: 412-40

Saturday, October 21, 2006: 442-29

Saturday, October 28, 2006: 480-40

Saturday, November 4, 2006: 251-57

Saturday, November 11, 2006: 388-48

Saturday, November 18, 2006: 541-55 - most new highs in 2006 (weekly average)

Piranha

Labels: NH-NL Ratio

1 Comments:

that would be pretty cool awesome article here. And then it's a latest stock market trends also. thanks for the update.

UK finance

Post a Comment

<< Home