Market Talk with Piranha

This blog serves as an internet community that aims to teach investors how think about investing by providing detailed market analysis using both fundamental and technical analysis. I invest my money by using solid rules that incorporate money management techniques such as position sizing, expectancies and cutting losses short! Through my philosophy and writings, I hope investors of all kind will be able to create their own methods and styles to become successful.

Tuesday, December 12, 2006

Wednesday, December 06, 2006

Super Speculation – Yes – Tips are for Suckers:

Many of you may have heard of Calpine and how they went into bankruptcy and how they are selling various parts of their business. I was recently having a conversation with someone in the industry (hedge fund) and they mentioned how several traders are going long Calpine (CPNLQ) on pure speculation based on rumors that the company may restructure and move forward. I don’t know if it is true but I took a look at the chart after his request and see that the stock is up several hundred percent on very heavy volume since late October but is extremely extended above the major moving averages for the first time in years. It closed at $0.91 on Tuesday (down from the $1.23 peak) as some people believe it is worth $6 per share.

Many of you may have heard of Calpine and how they went into bankruptcy and how they are selling various parts of their business. I was recently having a conversation with someone in the industry (hedge fund) and they mentioned how several traders are going long Calpine (CPNLQ) on pure speculation based on rumors that the company may restructure and move forward. I don’t know if it is true but I took a look at the chart after his request and see that the stock is up several hundred percent on very heavy volume since late October but is extremely extended above the major moving averages for the first time in years. It closed at $0.91 on Tuesday (down from the $1.23 peak) as some people believe it is worth $6 per share.I have no idea if this is true and I have always been taught that TIPS ARE FOR SUCKERS so please beware if you decide to speculate with extreme risk. I take this information as a tip even though my friend is a childhood buddy but I am curious to watch what will happen.

Again – this is by no means a recommendation to buy and major losses could occur if you were to speculate in this stock (I must make these statements to protect the legal aspect of my words). None of the stocks on this blog are buy or sell recommendations; just equity research based on specific criteria as noted in my disclaimers!

I prefer to buy stocks making new highs and I am not a bottom fisher. The only reason I even present this stock is because a very good friend of mine asked me to look at the chart and I thought I would share since I did the analysis.

Disclosure: I do not own any shares in Calpine (CPNLQ)!

-Chris

Tuesday, December 05, 2006

Moving to WordPress

I am finally making the change and it is painful at times, especially since there is no import from blogger beta to WordPress (I should have stayed on the regular blogger platform). I used my RSS feed to get my text over to my new WordPress blog but most of the images and charts do not show up. The charts and images occasionally show through IE7 but not through Firefox 2.0. It looks like I will have to re-enter my 238 posts with images from my new server (MY OWN SERVER –finally) or I can wait for a more advanced import tool from WP. My other problem will be the links to blogger titles in many of my posts. I will keep the blogger blog for a while but don’t want duplicate content on two sites as it will hurt the page ranking of both (from what I understand).

In any event, please bear with me over the next couple of weeks as I make the full transition from Blogger to WP as I am just learning the software and will be testing tools and widgets, etc…

My new blog and future home will be at http://www.chrisperruna.com/. I will continue to blog primarily about the stock market but will add a few more subjects that may interest my readers. Take a look and let me know what you think.

Thanks,Chris

Friday, December 01, 2006

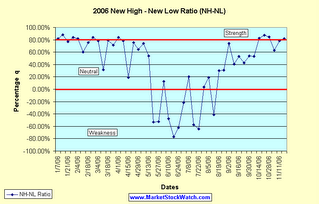

New High - New Low Ratio

Here’s the latest NH-NL ratio chart with weekly numbers updated to the week prior to the Thanksgiving holiday. I excluded the short week so it wouldn’t skew the chart. Although the week ending on Saturday, November 18, 2006 had the highest average number of new highs (541) for the year, the strength calculation ranked it tenth in 2006 behind many of the readings from January and October. New highs were greater during the week of 11/13-11/17 but the strength was less than three of the weeks in October which saw the number of new lows 30%-50% lower. Both sets of numbers play an equal role in the calculation of this NH-NL strength ratio.

Yesterday saw a reading of 525-35 which equals an 87% rating but the readings were weaker earlier in the week so the total won’t make the top 10 (as long as today is quiet). In addition to the NH-NL chart, I wanted to post the chart of the number of stocks on the S&P 500 that are trading above their 50-d m.a. because it has slipped to its lowest level since August.

To calculate the percentage correctly, use this formula:

(New Highs – New Lows) / (New Highs + New Lows) * 100 = X%

Below is an updated look at the weekly averages for the NH-NL Ratio:

Saturday, January 14, 2006: 500-32

Saturday, January 21, 2006: 348-46

Saturday, January 28, 2006: 516-46

Saturday, February 4, 2006: 449-44

Saturday, February 11, 2006: 229-57

Saturday, February 18, 2006: 306-42

Saturday, February 25, 2006: 420-36

Saturday, March 04, 2006: 399-49

Saturday, March 11, 2006: 162-84

Saturday, March 18, 2006: 459-53

Saturday, March 25, 2006: 312-52

Saturday, April 01, 2006: 441-39

Saturday, April 08, 2006: 481-58

Saturday, April 15, 2006: 150-103

Saturday, April 22, 2006: 540-75

Saturday, April 29, 2006: 353-76

Saturday, May 6, 2006: 503-74

Saturday, May 13, 2006: 384-116

Saturday, May 20, 2006: 64-211

Saturday, May 27, 2006: 57-182

Saturday, June 3, 2006: 119-93

Saturday, June 10, 2006: 72-204

Saturday, June 17, 2006: 41-310

Saturday, June 24, 2006: 56-238

Saturday, July 01, 2006: 127-198

Saturday, July 08, 2006: 143-95

Saturday, July 15, 2006: 74-273

Saturday, July 22, 2006: 66 - 307

Saturday, July 29, 2006: 163-151

Saturday, August 5, 2006: 194-132

Saturday, August 12, 2006: 88-210

Saturday, August 19, 2006: 178-96

Saturday, August 26, 2006: 140-74

Saturday, September 2, 2006: 285-42

Saturday, September 9, 2006: 143-60

Saturday, September 16, 2006: 244-75

Saturday, September 23, 2006: 206-83

Saturday, September 30, 2006: 251-75

Saturday, October 7, 2006: 301-92

Saturday, October 14, 2006: 412-40

Saturday, October 21, 2006: 442-29

Saturday, October 28, 2006: 480-40

Saturday, November 4, 2006: 251-57

Saturday, November 11, 2006: 388-48

Saturday, November 18, 2006: 541-55 - most new highs in 2006 (weekly average)

Piranha

Labels: NH-NL Ratio