Mid-Year Rally?

Thursday's move was powerful and it was powerful on several levels. I say this because the new highs list on the daily screen is the strongest I have seen since the end of March. The MSW Index stocks were simply amazing and have a 5% gain for the week (a total of 14 stocks – 8 of them are up more than 6% with two in double digits). Several stocks we have been following together over the past several weeks broke out or moved to new highs, many on above average volume – a sure sign of accumulation. The Fed raised the rate by 25 basis points to 5.25%, the 17th in the past two years but also gave investors an idea that they may slow the aggressive hikes in the future. Remember, the market typically prices-in future news six months in advance so we may be starting to see the positive move we want six months before the Fed stops raising rates. HOWEVER, I will not base that assumption on one day of strong moves with strong volume but everything starts somewhere and today is that kind of day.

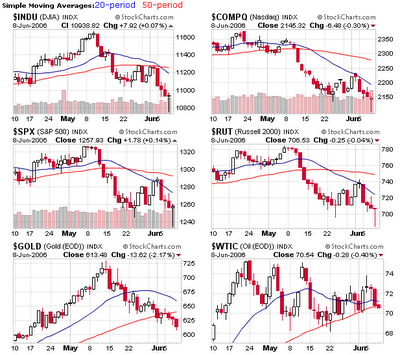

The NASDAQ was up 3% on volume 35% larger than yesterday while the DOW was up 2% on volume 26% larger than yesterday (the first major accumulation day in weeks, if not months). We never undercut the previous low set before the attempted rally so technically this can be a follow-through even though I marked it dead on Wednesday. I will now look for an additional follow-up move to confirm this move but the stop sign has been lifted for buying stocks. If you decide to start placing positions, please continue to use caution and strict selling rules so you don’t get whipsawed and lose a large amount of money in a short period of time. Use the proper position sizing techniques based on the size of your portfolios. Today was the largest daily gain for the DOW since April 2005, the largest for the NASDAQ since March 2004 and the largest for the S&P 500 since October 2003.

Another solid sign was the NH-NL ratio which recorded its first positive ratio (186-126) in 19 trading days (31 of the past 33 days have been negative).

So, how do we know if this is a true rally? The next step is to watch the leading stocks and start to place some test buys (about 1/3rd your typical position size) and see what happens. If you make money, the rally is telling you something, if your positions turn against you, it may be another bluff. I don’t know the answer but I will soon enough as I will be placing a few test buys. Depending on the action in the market tomorrow, I could be writing a great weekly analysis and updated MSW Index. Days like today are fun and I have been waiting for something like this to happen for a long time. I go on vacation Saturday but I am definitely bringing my laptop so I am able to watch the market and make moves next week.

As the Stock Trader’s Almanac states: the NASDAQ’s mid-year rally from the end of June through mid-July is strongest. The NASDAQ has been averaging a 3% gain since 1987 from the end of June to the second week of July versus 0.1% for the entire month of July. History also states that the gains over the next four months will be solid if July provides us with huge gains. In any event, continue to follow the price and volume of the indexes, the NH-NL ratio and individual market leaders.

Piranha