Current Market Temperature

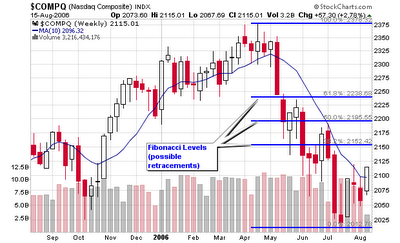

The NASDAQ is following the Fibonacci plan of action to a ‘T’! It retraced to the 38.2% level and then consolidated for a week as I noted and is now hitting resistance near the 50% retracement level. It wasn’t really a question of if but when the NASDAQ would reach to the 50% retracement level. The index faces a decision once again: to consolidate one more time before attempting to move to the next retracement level or pull back and gain some support near the 50-d moving average. I still suspect a pull-back to the 50-d m.a. as the index still needs to fill a gap-down in that area (see the NASDAQ daily chart provided). I will not guess what the index will do and will only trade the signals.

Looking at the daily chart of the NASDAQ, we can see that the index is now trending higher and has been since it started to retrace. Volume has been weak but that can be attributed to end of summer conditions. Volume should start to pour back into the market as September carries on and institutional investors return from vacation.

A closer look at the weekly chart will show you that the NASDAQ is now testing long term resistance just below the 2,200 level (very similar to the Fibonacci retracement level of 50%). Again, volume is weak so I am not sure if the index will have the power to overtake this area but I will watch to see if a trading range forms between 2,100 and 2,200. Look back exactly one year to see what I am taking about.

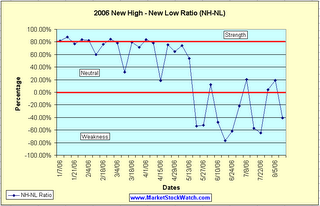

The percentage of stocks making new highs on the S&P 500 is still near four month highs so I am not concerned about any weakening of the potential individual leaders. The NH-NL ratio has been positive for the most part but not overwhelming with strength. As long as it stays positive, we don’t have too much worry about.

The Gold chart is similar to the NASDAQ retracements as I wanted to point out how the commodity is using the Fibonacci levels as support and resistance. Currently, the commodity is using the 38.2% retracement level as support as it trades in a sideways range between $600 and $650 with larger support below near the 200-d m.a. Notice how Gold reached the third retracement level and then sold off to consolidate into its current range. The move could be considered textbook to some.

Both the DOW and S&P 500 are forming cup shaped patterns with support below at their respective moving averages. I am interested to see what will happen as they approach all-time highs (if they can in the next couple of months). When they approach these highs, study the RSI chart to see if the buying is coming in with strength. As a follower of CANSLIM, I would love to see both indexes form a cup with handle pattern and then break-out with powerful volume along with individual leaders. That type of action could start a rally.

Finally, I will focus on the crude oil contracts as we can see that they are testing support near $70 with more support at the 200-d m.a. (slightly higher than $68). I would not become concerned with crude oil until it sold below the 200-d m.a. on heavy volume which could and most likely would propel stocks in the opposite direction. The combination index I have uploaded shows the relationship between crude oil and the NASDAQ and the current short term trend is higher while the longer term trend is still lower.

Enjoy and click on each chart for a larger view!

Piranha

Labels: General Market

The quotes below are provided by John F. Carter, master day trader; pulled directly from his new book

The quotes below are provided by John F. Carter, master day trader; pulled directly from his new book